Go beyond the planning and make sure all the doing gets done.

Help your clients take action on the details of their financial life that typically get ignored, kicked down the road, or fall through the cracks and free up your time to focus on the highest value-add activities.

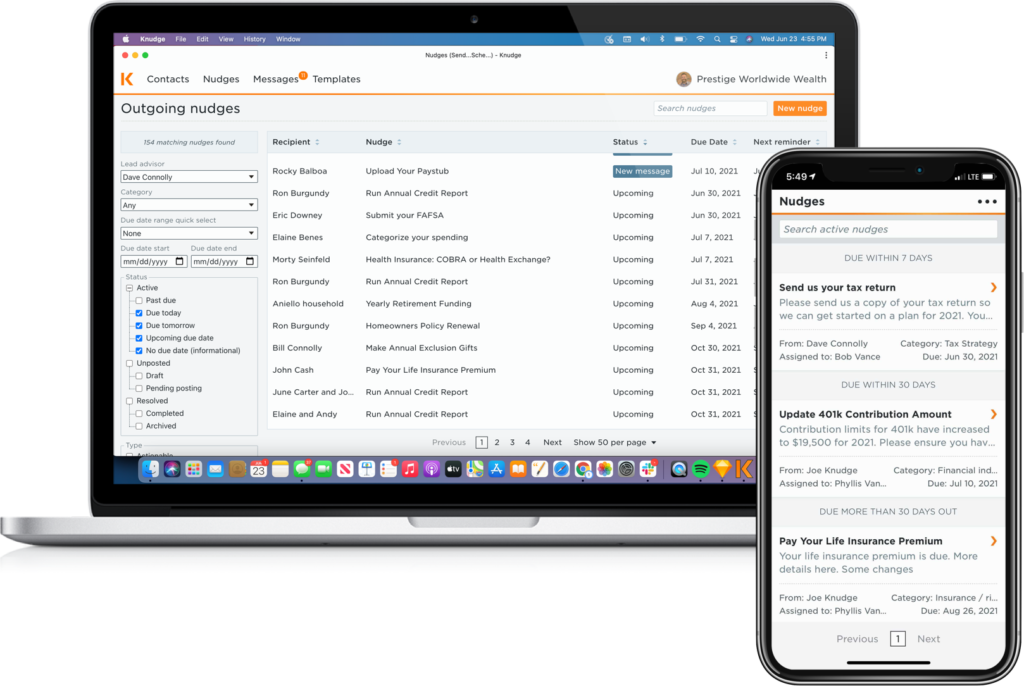

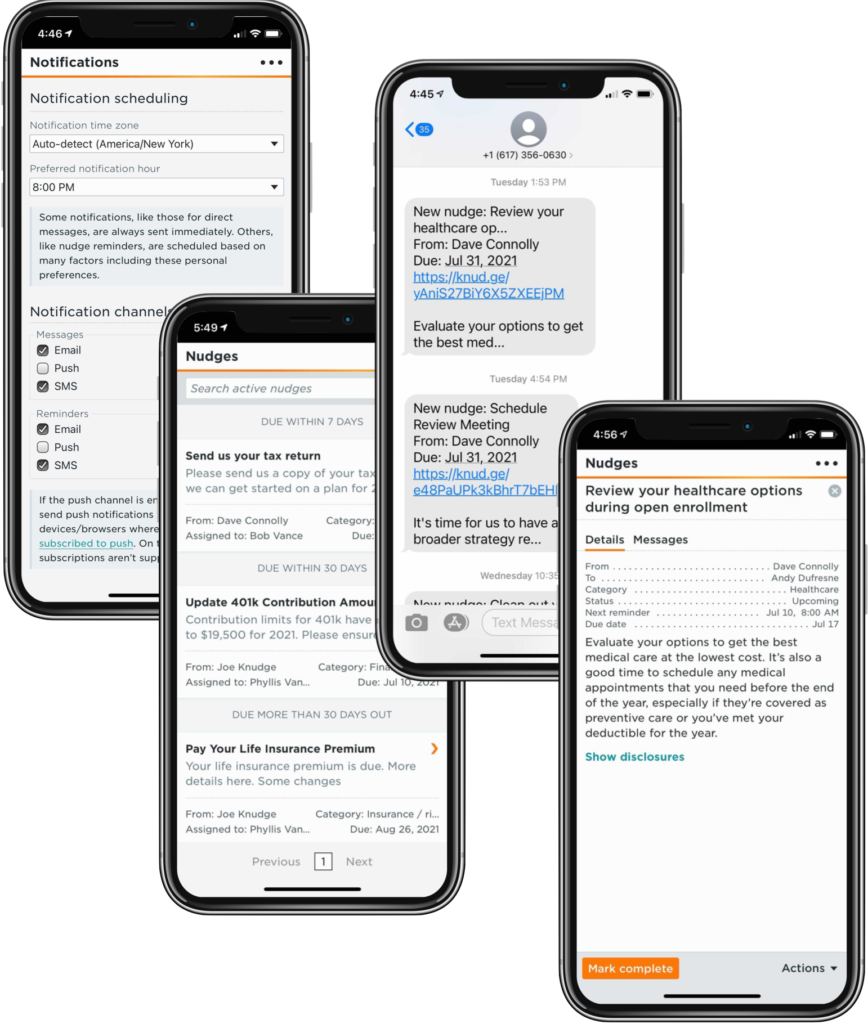

Your clients don’t need to register or login to a new tool: They can simply receive reminders via email or text. If they choose to register or install the app, they can also set their preferences for when and how they’d like to receive reminders and see a shared to-do-list of assigned tasks.

Never let anything fall through the cracks: Knudge provides a shared to-do-list that also sends timely reminders via email, push notification and/or text notification.

Empower your clients to be held accountable the way they want: Clients can set preferences for when and how they’d like to receive communications.

Collaborative communication: In-app messaging integrates with email and text for rapid communication and all messaging stays attached to the associated action item.

Client prioritization: The advisor dashboard aggregates action items across your client base and highlights items that require attention.

The top rated platform for Advice Engagement

Knudge received the highest value and satisfaction ratings of any provider in the Advice Engagement category in the 2023 Kitces.com AdvisorTech Study “The Technology That Independent Financial Advisors Actually Use and Like”

Thank you to all our users who shared their reviews and thank you for sharing your feedback with us along the way to help us make Knudge the premier advice engagement tool in the industry.

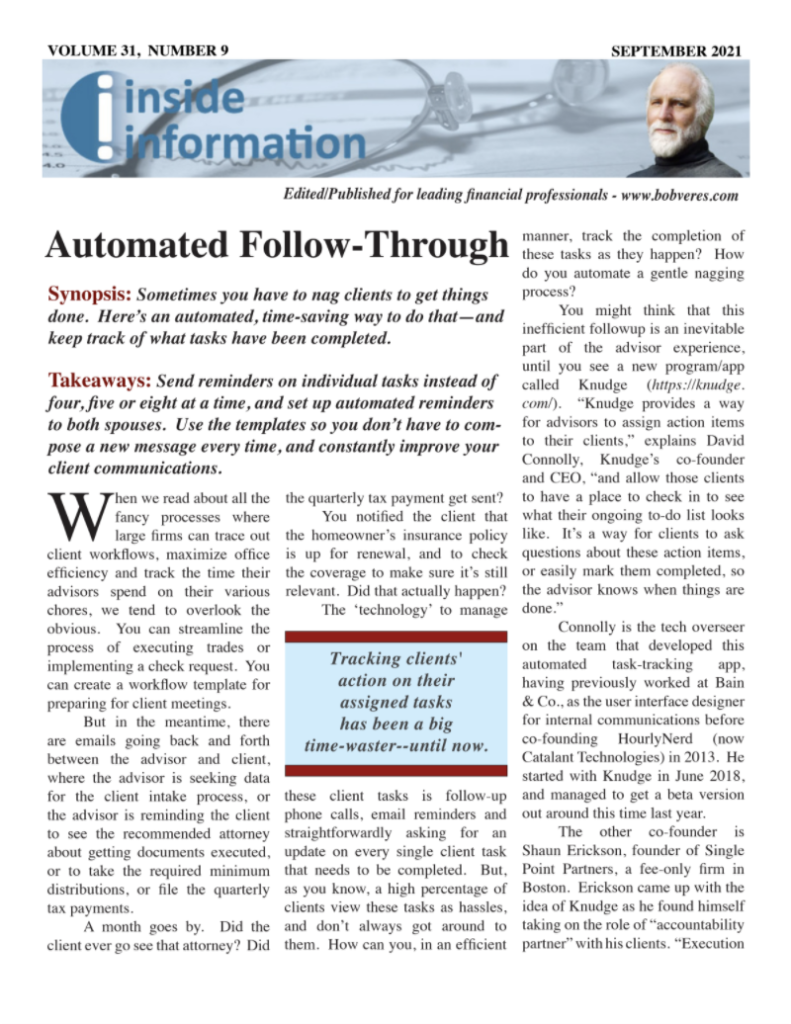

You might think that inefficient followup is an inevitable part of the advisor experience, until you see a new program/app called Knudge.”

Founder Inside Information

Bob Veres’ article from his Inside Information newsletter talks about how Knudge is addressing an important need and explains how Knudge is being used by other advisors to manage their clients’ action items.

If you’re not familiar with the Inside Information newsletter, we highly recommend subscribing. It’s a great way to keep up with the ever changing financial planning industry.