Welcome to the Knudge Help Center

Still have questions? Email us at support@knudge.com or schedule some time so we can answer your questions and share some tips to help you get the most out of Knudge.

Dealing Procrastination a Body Blow

Long ago, I wrote my doctoral dissertation on procrastination. (I completed it in record time, too, thank you very much!) As you might imagine, I encountered a few logistical problems while studying procrastinators. After all, these were people with personality traits such as low conscientiousness and a tendency towards impulsivity. Just getting them to show up on time was a major challenge. Getting them to return calls and paperwork was a nightmare. Sound like the sort of thing you might encounter as a financial advisor?

But what started out for me as an incidental nuisance variable – dealing with the inherent unreliability of procrastinators – began to interest me more and more. And what came out of that experience is part of what informs our work at Knudge.

Here’s what emerged from […]

What Goes into a Nudge?

Ever Wonder What Goes into a Nudge?

Read below to understand when Knudge begins sending reminders, how often reminders are sent, the logic behind the notification period, and how to send a nudge manually.

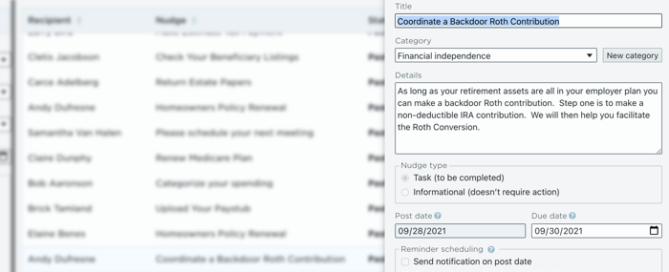

Post Date:

The post date dictates when a nudge gets added to a contacts shared to-do-list. If you elect to send a notification on post date it will also send a communication on this date. Knudge will select an optimal cadence to reach out based on the due date.

Here is an example: After a meeting, Bill needs to update his estate plan. You know Bill needs to complete the task before the new year, but it’s only July. […]

Don’t be scared to nudge your clients….

Many Advisors new to Knudge ask us whether they should send individual nudges for each task or group a bunch of tasks into one nudge. The fear is that setting up a bunch of individual nudges would cause their Clients to be “nudged” too many times, more times than the advisors typically contact their Clients.

Our research shows that people get more benefit from individual nudges. Discrete nudges make it easier for clients to manage their to-dos and allow them to mark individual ones complete. It’s a great way to give Clients a sense of accomplishment for completing a task. You and your Client can also have conversations about a specific nudge and organize them under one task. This makes it easier to find and reference later.

If that’s a big change for you, because you typically send […]

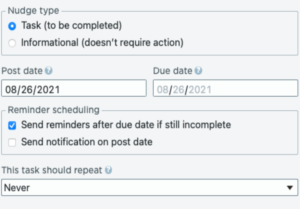

How often are reminders sent?

Knudge’s reminder algorithm determines the optimal time to send reminders to clients.

Advisors don’t need to worry about scheduling the reminders when they create action items for their clients, but it’s good to know how it all works.

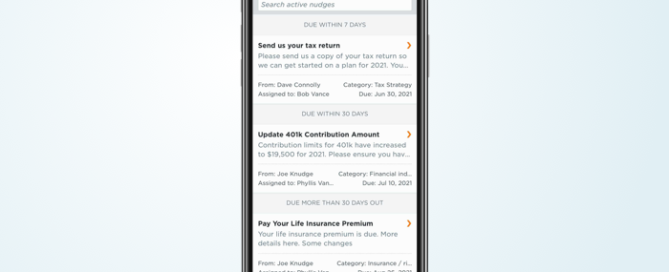

If time allows, Knudge sends three reminders leading up to the due date.

If there is a long span of time between the posted date and the due date, the first reminder could go out as much as a month before the due date but it’s usually one or two weeks before the due date, the second and third reminders are sent closer to the due date. You can also elect to send an additional notification when the nudge is posted by checking “Send notification on post date” when you create the nudge.

There are many factors that determine when reminders are sent. Some of […]

Dr. Moira Somers joins Knudge as our Behavioral Strategist

“What’s the point of technically proficient advice if the client won’t act on it?”

I “borrowed” this line from Dr. Moira Somers in Sept 2019 at the XYPN Live Conference Tech competition. We presented and introduced Knudge to the financial planning community on the same day Dr. Somers was giving a keynote address at the conference. Having been a massive fan of her book “Advice that Sticks”, I thought I could use a distraction from my nerves for my upcoming presentation so I sat in on her keynote.

That line she delivered perfectly summed up why Knudge was created. So I used the exact line in our presentation (with full credit of course).

Fast forward two years later and I could not be more thrilled to announce that Dr. Somers is joining the Knudge team as our Behavioral Strategist.

You see, my […]

How to Take the Dread Out of Your To-Do List

As a financial planner, we know that there are a lot of potential barriers to our clients taking the steps required to get (and keep) their financial lives in order

In this guest post, Emily Shull, a Certified Money Coach from Me, Myself and Money addresses some of the emotional barriers we all struggle with in making changes and provides us with tips on how to help address those.

It is part of our job as advisors to facilitate conversations around the emotional barriers Emily outlines below. It’s also important for us to recognize that sometimes our clients just aren’t ready for all the changes we may want them to make, so we need to hear them and focus on the steps they are ready to take.

Once your clients have committed to making changes, […]