For this equity comp advisor, Knudge is his daily driver for client communication.

When TJ van Gerven reaches out to clients, most often, he does it with a nudge.

The Boston-based advisor serves millennials receiving equity comp and kicks off the relationship with a nudge to upload their docs into the Right Capital vault. As he works through the initial planning process – in his case, this is a monthly meeting for the first quarter – he will send a follow-up Loom video embedded in a nudge.

Once the relationship is in flight, TJ sends a variety of nudges to keep it running smoothly.

“I try to use it for everything now,” he said. “[Especially] because it integrates with Wealthbox for notes.”

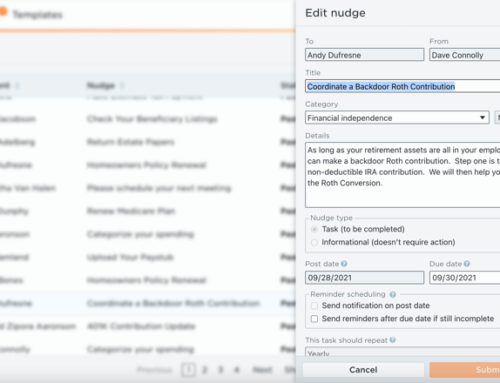

On a quarterly basis, clients receive informational nudges (these are nudges that send just one notification) to invite them to schedule a meeting. He also assignes nudges for any action items that come out of the meeting.

To avoid multiple logins for his clients, he rarely invites them to register for the platform. While some receive text messages, most of TJ’s clients receive and respond via the emails Knudge sends. For TJ, this has been a boon.

“Before, I didn’t have a system for action items. I had to manually email somebody to follow up with them,” he said. “Now, I don’t have to worry about it because Knudge will just keep following up with them. “

Off-cycle, TJ helps clients stay on top of things by scheduling nudges to coincide with open trading windows as reminders to sell RSUs or exercise options. And he makes sure there’s a quarterly nudge for his clients who pay estimated quarterly taxes so they don’t forget.

“I could easily sell any advisor who is looking for an action item system on Knudge.

Before, I didn’t have a system for action items. I had to manually email somebody to follow up with them. Now, I don’t have to worry about it because it will just keep following up with them.

For me, anything less than $1,000 a year for a piece of tech that I’m using on a regular basis is very affordable.”

Sometimes, TJ adds nudges just to let clients know the work is getting done.

“If I process a Roth conversion or something, I’ll informationally nudge them and that also links to Wealthbox so that there’s a note there,” he said.

And that’s not the only reason he does it.

It’s the Matthew Jarvis dishwasher rule,” he said. “If you don’t show the client what you’re doing, you don’t get credit for it.”

A few of TJ’s nudges:

- Book your meeting

- Re-sync your account data in Right Capital

- Sell or exercise in the trading window

- Pay your estimated quarterly taxes

Two more things TJ does with Knudge:

- Demonstrates value (I did a thing for you!)

- Ask clients for Google reviews

TJ has a word of advice for advisors who are thinking about adopting Knudge:

“I would say that you have to be all in on it, using it as your notes section as well and having it integrate with Wealthbox,” he said. “For me, anything less than $1,000 a year for a piece of tech that I’m using on a regular basis is very affordable.”