Advisers are using insights from behavioral economics and social psychology to steer people’s decisions in a direction that should benefit them

Excerpt from article by Alain Samson and Prasad Ramani originally published in Investment News

Client perceptions of a financial adviser’s service are ultimately determined by how effectively it delivers to their personal financial objectives or long-term lifestyle goals. As financial advisers’ role evolves more and more into that of a financial life-coach, advisers need to build strong client relationships and foster trust.

To add value to their services, some advisers have begun to “behavioralize” their work by helping clients make better financial decisions. One approach to achieve this objective is to educate clients about investment errors and pitfalls in an attempt to de-bias their thinking and choices.

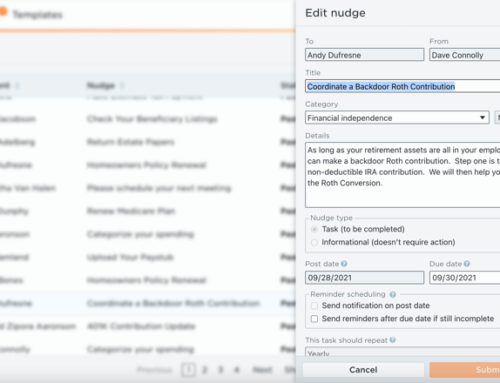

Another, complementary way that has gained in popularity in recent years involves nudges. This approach utilizes insights from behavioral economics and social psychology to gently steer people’s decisions in a direction that should benefit them.

…Individuals who are busy, prone to form strong habits or have high levels of regret aversion, for example, may be particularly likely to suffer from a failure to act. Individuals with low levels of education or knowledge in a particular domain, such as financial literacy, are most vulnerable to uncertainty. A person’s cultural background and dispositions, such as uncertainty and ambiguity intolerance, can aggravate subjective uncertainty. Very young and old people tend to have higher levels of impatience. Negative life events or conditions, such as financial hardship, can also increase impatience due to a reduction of mental bandwidth and a focus on immediate needs.

To find out which nudge works best for a particular problem and client, firms and even independent advisers can employ simple, cost-effective experiments with test and control groups.

You can implement nudge techniques throughout the client journey by identifying touch points and opportunities for behavior change before tailoring your communications accordingly.

In 21st century financial advisory, personalization is king. You can take this practice to the next level if you work with a nudge that fits not only the problem, but also your client.